Why Do You Need an Auto Insurance Card?

An auto insurance card is an essential part of your driving toolkit. This document is vital in various situations you may encounter as a driver or vehicle owner.

Imagine you're driving, and you see the flashing lights of a police car signaling you to pull over. During such traffic stops, one of the first things an officer will ask for is your auto insurance card. It proves you are operating your vehicle with the legally required insurance coverage. Presenting this card promptly can lead to a smoother interaction with law enforcement, showing that you are a responsible and law-abiding driver.

Accidents, whether minor or significant, are stressful events. In these moments, your auto insurance card becomes invaluable. It provides all the necessary details to exchange with other drivers, such as your insurance agent and policy number. This information is crucial for filing reports and insurance claims.

The consequences of not having your auto insurance card when required can be pretty significant. In many regions, failing to provide proof of insurance during traffic stops or after an accident can result in penalties ranging from fines to suspending your driver's license. In some cases, your vehicle may even be impounded. Moreover, not having your insurance card readily available can delay resolving claims and repairs.

What Is an Auto Insurance Card Template?

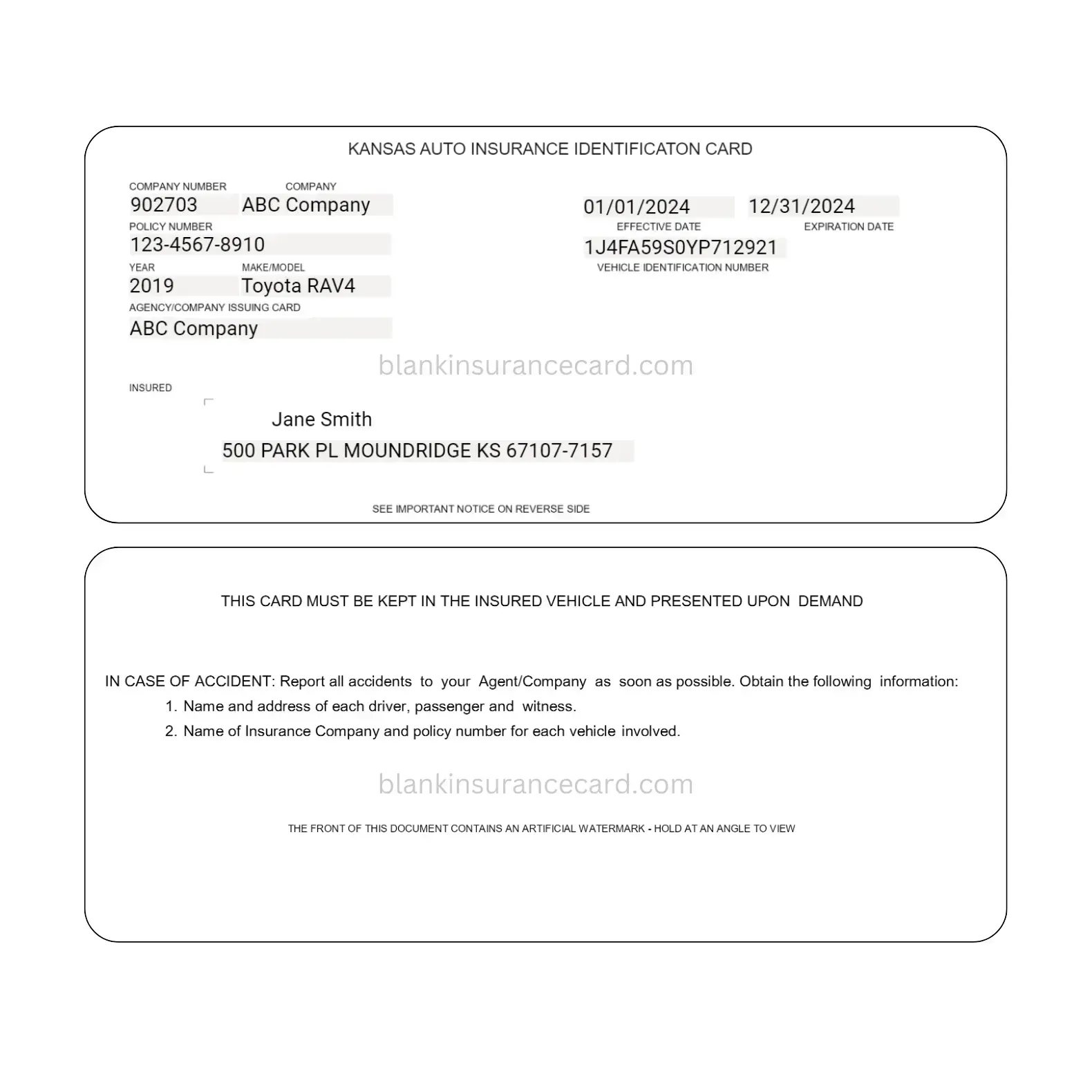

An auto insurance card template is a standardized format or layout that outlines the critical information your card should include. Insurers often provide these templates, but they can be created using various online tools. The car insurance template includes designated spaces for details such as your name, policy number, insurance company's contact information, vehicle identification number (VIN), policy effective dates, and coverage types. Below, we will look at all the benefits of using an auto insurance card template.

Ensuring Complete Information

One of the primary advantages of using a template is the assurance that you won't miss any critical information. The template acts as a checklist, ensuring all necessary details are included. This is particularly helpful for new drivers or those unfamiliar with what an auto insurance card should contain.

Ease of Updating Information

Life changes, and so does your insurance policy. Using a template makes it easy to update information as needed. Whether you change your vehicle, switch insurers, or update your coverage, a template allows quick and hassle-free modifications. This ensures that your auto insurance card always reflects your current situation.

Consistency and Clarity

Templates provide a consistent format, which is beneficial for you and those who might need to review your insurance information, like law enforcement or other drivers in the case of an accident. A standardized format makes important details easy to find and understand, facilitating smoother interactions in various scenarios.

Professional Appearance

An auto insurance card created using a template looks professional and organized. This might seem minor, but a well-structured and clear layout can convey a sense of responsibility and attention to detail when presenting your insurance identification card.

What Information Is Typically Included on an Auto Insurance Card?

When it comes to your auto insurance card, certain pieces of information are essential to have on hand. Also, understanding and verifying your auto insurance card details is vital for every driver. So, each insurance card template includes:

-

Insurance Policy Number. It's the first thing you'll need in case of an insurance claim or any communication with your insurer. This number is what links you to your specific policy details and coverage.

-

Policyholder's Name. Ensuring this name is accurate and matches other identification documents is crucial. In cases where multiple family members drive the car, the policy might list additional drivers.

-

Vehicle Information. This includes the insured vehicle's make, model, year, and VIN (Vehicle Identification Number). Accurate information is crucial, as it is used to track the vehicle's insurance history.

-

Effective and Expiration Dates. Keeping track of these dates is crucial to avoid driving with an expired policy. Renewing your policy well before expiration is advisable to ensure continuous coverage.

-

Insurance Company Contact Information. This readily available information is essential for quickly contacting an insurance company in case of an accident or if you need roadside assistance.

-

Type of Coverage. Your card typically outlines your coverage type, such as liability, comprehensive, or collision. This gives a quick overview of what your policy covers.

-

Coverage Limits. This refers to the maximum amount your insurer will pay under a policy. It is essential to know your limits to assess whether you have adequate protection against potential losses.

Each field on your car insurance card template serves a specific purpose, providing a snapshot of your coverage. It's crucial to ensure this information is present and correct and to understand what each detail means. Remember, your auto insurance card is more than just a requirement; it's a tool in your vehicle's safety and legal compliance kit.

How to Obtain an Auto Insurance Card Template?

The steps in obtaining an auto insurance card template are more straightforward than you might think. If you want a template from your insurance company, this guide will walk you to ensure you have a comprehensive and up-to-date auto insurance card.

1. Contact Your Insurance Company

The first and most straightforward way to get an auto insurance card template is by contacting your insurance provider. Most insurance companies offer digital access to your insurance card through their website or mobile app.

2. Download or Request a Physical Copy

Once logged in, you can typically download a digital copy of your auto insurance card. Some insurers also give you the option to request a physical copy, which they will mail to your address. This process is usually quick and ensures that the template you receive is accurate and in line with your specific policy.

3. Check for Updates

It's essential to check for updates regularly, especially if there are changes in your coverage details. Make sure to download or request a new card template every time there's an update to your policy to keep your information current.

How to Create an Auto Insurance Card?

Creating an auto insurance card template is integral to managing your vehicle's coverage. By following these steps, you can ensure that you always have up-to-date and accurate proof of insurance, keeping you prepared and protected on the road.

1. Choose Your Online Tool

Start by choosing an online platform with fillable auto insurance cards. Ensure the tool offers the flexibility and features you need to create an insurance card.

2. Sign Up or Log In

If you're a new user, you'll need to sign up. Existing users can simply log in. This step is crucial as it often allows you to save and edit your documents.

3. Find the Right Template

Once logged in, go to the template section. Look for templates related to auto insurance or similar documents. You can choose a general insurance or identification card template as a base if there isn't a specific auto insurance card template.

4. Customize the Template

After selecting a template, customize it with your specific information. It includes your insurance policy number, policyholder's name, vehicle information, insurance agent contact details, and the effective and expiration dates. Ensure the layout is clear and the text is readable. The most critical information should be easily visible.

5. Review and Edit

Carefully review the information for accuracy. Double-check for typos or errors, and ensure all the necessary insurance coverage details are included correctly.

6. Save and Print

Once you are satisfied with the template, save it. You can then download it for printing. Some online tools also offer options to save in different formats (like PDF or JPG), depending on your needs. Also, print the form on quality paper and consider laminating it for durability, especially if you plan to keep it in your vehicle.

Conclusion

An auto insurance card is crucial for every driver, serving as proof of insurance and ensuring legal compliance. It is essential in various situations, such as during traffic stops or after accidents, and helps facilitate claims and reporting processes. Not having it or providing fake cards can lead to penalties, legal issues, and delays in accident management.

So, keeping such proof of insurance updated and readily available is part of being a responsible driver. Also, using fillable auto insurance templates simplifies maintaining current information, ensuring you're always prepared for any driving situation with confidence and responsibility.

Related Posts

Look through the following collection of links to obtain comprehensive resources and templates related to Auto Insurance Cards:

- Decoding No-Fault and Tort Insurance Systems

- Grasping the Essentials of Financial Responsibility Laws

- Know Your Coverage: State-Specific Insurance Laws Explained

- How to Navigate Accident Forgiveness Programs

- The Essentials of FR-44 Insurance Explained

- SR-22 Insurance: Breaking Down the Facts About SR-22 Filing

- Customized Protection for High-Risk Drivers: What You Need to Know

- The Road to Coverage: Unveiling High-Risk Insurance

- Your Complete Guide to Filing Car Insurance Claims

- How to Save with Hybrid and Electric Vehicles

- Affordable Auto Insurance on Your Terms: Pay-as-You-Drive

- Usage-Based Discount Strategies: How It Works

- Smart Strategies for Multi-Vehicle Discount Savings

- Your Guide to Maximizing Multi-Policy Savings

- How Mature Drivers Can Save on Insurance

- The Teen and Student Driver Discount Breakdown

- Understanding Good Driver and Safe Driver Discounts

- A Comprehensive Car Insurance Discounts Guide

- What You Should Know About UM/UIM Coverage

- The Ins and Outs of Collision Insurance

- A Guide to Liability Insurance: How It Protects You

- Getting Deep Into Comprehensive Coverage: Your Ultimate Guide

- Auto Insurance Decoded: What You Need to Know About Coverage